Living in San Antonio means being prepared for unpredictable weather, including hailstorms, high winds, and heavy rain, all of which can cause serious roof damage. If your roof has been damaged, understanding how to file a roof damage insurance claim is essential for safeguarding both your home and finances. This guide will walk you through the process step-by-step, helping you make informed decisions and navigate the complexities of roof damage insurance claims.

Understand Your Homeowners Insurance Policy

Before you file a claim, take the time to review your homeowners insurance policy carefully. Know what types of roof damage are covered, including hail damage, wind damage, fire, or falling debris. It’s also important to be aware of policy exclusions like normal wear and tear, neglect, or damage caused by insects or rodents, as these are typically not covered by roof damage insurance.

Familiarize yourself with important terms such as deductible (the amount you pay out of pocket before your insurance covers the rest), replacement cost value (the cost to replace your roof with new materials), and actual cash value (the depreciated value of your roof at the time of the damage). Understanding these terms will help you know what to expect financially and how your coverage works.

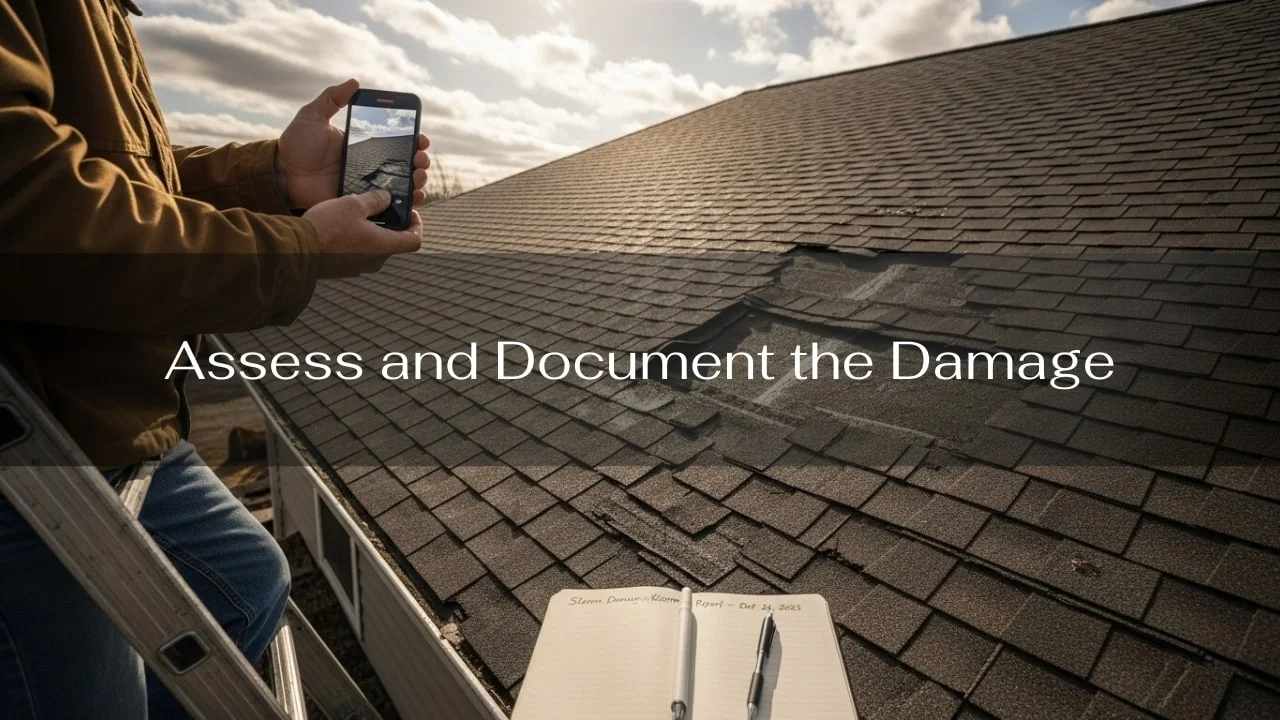

Assess and Document the Damage

After a storm or if you suspect roof damage, safely inspect your roof or hire a reliable roofing contractor to assess the damage. Be sure to document everything thoroughly with clear photos and videos. Note any missing or damaged shingles, leaks, water stains, or sagging sections. Also, keep records of the date and circumstances surrounding the damage.

Contact Your Insurance Company Promptly

Notify your insurance provider as soon as possible to initiate the roof damage insurance claim process. Provide them with your policy number and detailed information about the damage. Early contact is essential, as many policies have deadlines for filing claims after major weather events or significant damage.

Schedule an Inspection with an Insurance Adjuster

Your insurance company will send an adjuster to inspect your roof and verify the damage. Be present during this inspection to point out all areas of damage and present your documentation. If you have a trusted roofing contractor, they can assist you by providing an estimate and advocating for necessary repairs.

Obtain Estimates from Reputable Roofing Contractors

Before agreeing to any settlement, get multiple estimates from licensed and insured roofing contractors in San Antonio. These estimates will help you compare the insurance company’s offer and ensure it covers the full scope of the needed repairs.

Review and Negotiate Your Settlement

Once the insurance adjuster submits their report, your insurer will provide a settlement offer. Review this offer carefully to ensure it reflects the extent of the damage and the cost of repairs. If the offer falls short, you can negotiate by providing additional estimates or documentation from your roofing contractor.

Avoid Common Pitfalls

- Do not delay filing your roof damage insurance claim, as waiting too long can lead to a claim denial.

- Avoid making permanent repairs before the insurance inspection, although temporary repairs, like placing tarps to prevent further damage, are acceptable.

- Maintain clear and detailed records of all communications with your insurance provider.

- Make sure your roofing contractor is reputable and experienced in handling insurance claims to avoid subpar work or potential scams.

Finalize Repairs and Claim Closure

Once you’ve agreed on a settlement, schedule the roofing repairs. Keep all receipts, invoices, and photos of the completed work. Submit this documentation to your insurance company to finalize the claim and receive any remaining payments.

Review Your Home Insurance Policy Regularly

After filing a roof damage insurance claim, review your policy to ensure you have adequate coverage for future incidents. Consider adjusting your deductible or coverage limits to better fit your budget and risk level.

Roof Repair San Antonio Roofing Company: Your Trusted Partner

For homeowners in San Antonio facing roof damage, partnering with a trusted local roofing company can make all the difference. A reputable roof repair San Antonio roofing company offers comprehensive services, from damage assessment and roof damage insurance claim assistance to expert roofing repairs and replacements. Our expertise in dealing with local weather challenges and navigating the insurance process ensures your roof is restored properly and efficiently, protecting your home for years to come.

If your roof has been damaged, don’t hesitate to contact a professional roofing contractor in San Antonio to help you through the roof damage insurance claim process and provide quality repairs you can trust.